ETH Price Prediction: Will Ethereum Shatter the $4,000 Barrier Amid Bullish Technicals and ETF Mania?

#ETH

- Technical Breakout: ETH trading above 20MA with MACD bullish crossover

- Institutional Catalysts: ETF approvals and corporate treasury adoption accelerating

- Price Targets: MVRV model suggests $5,140 as next macro resistance

ETH Price Prediction

ETH Technical Analysis: Bullish Signals Emerge as Price Nears Key Resistance

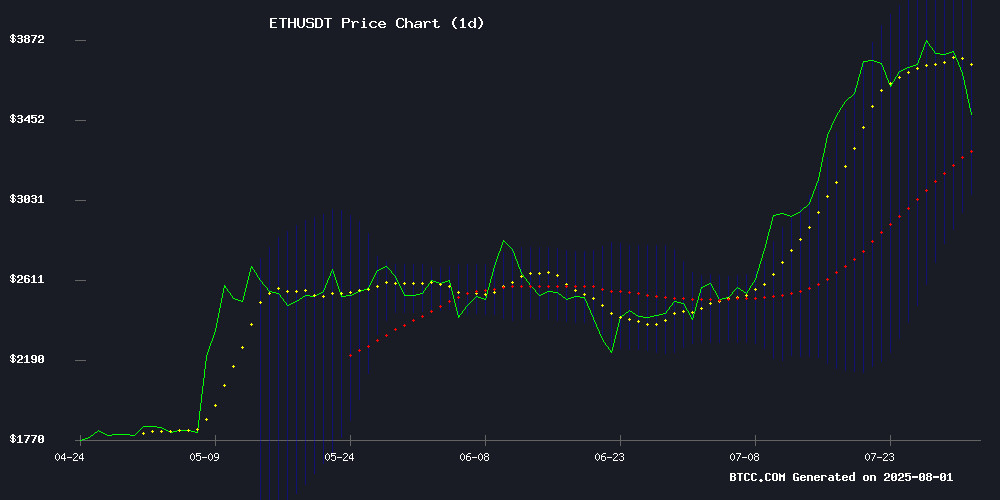

ETH is currently trading at $3,663.89, above its 20-day moving average of $3,590.77, indicating a bullish trend. The MACD shows a positive crossover with the histogram at 109.0494, suggesting upward momentum. Bollinger Bands reveal the price is approaching the upper band at $4,110.30, which could act as resistance. According to BTCC financial analyst Robert, 'The technical setup favors bulls, with a potential test of $4,000 if buying pressure sustains.'

Ethereum Market Sentiment: ETF Hype and Institutional Interest Fuel Optimism

Positive news flows dominate Ethereum's landscape, with ETF-driven monthly gains and corporate treasury adoption. The launch of tokenized stocks on ethereum and Vitalik.run's nostalgic game add utility-driven demand. BTCC's Robert notes, 'Institutional buildup and MVRV indicators aligning for a $5,140 target create perfect FOMO conditions.' However, he cautions that stalled inflows below $3,900 may trigger short-term profit-taking.

Factors Influencing ETH's Price

Ether Eyes Biggest Monthly Gain Since 2022 as ETFs, Corporate Treasuries Drive Rally

Ether (ETH) surged more than 50% in July, marking its strongest monthly performance since 2022. The rally peaked at $3,940 before settling near $3,800, fueled by institutional inflows and a shifting narrative around Ethereum's role in stablecoins and tokenization.

U.S. spot ETH ETFs absorbed $5.4 billion in net inflows, their best streak since launch. Corporate treasuries followed suit, with public companies accumulating $6.2 billion worth of ETH. Notable buyers include Bitmine and SharpLink, alongside newer entrants like ETHZilla and Ether Machine.

The gains reflect growing institutional confidence in Ethereum's infrastructure as the Genius Act stabilizes regulatory frameworks for stablecoins. With over half of all stablecoin activity hosted on Ethereum, ETH is increasingly viewed as a proxy for the broader tokenization market.

Ethereum Researcher Unveils Ambitious 10-Year Roadmap for 10k TPS Mainnet

Ethereum researcher Justin Drake has laid out a bold 10-year vision dubbed 'Lean Ethereum,' targeting 10,000 transactions per second (TPS) on the mainnet while hardening security against nation-state and quantum threats. The roadmap, published on the Ethereum Foundation blog on July 31, proposes restructuring the protocol's consensus, data, and execution layers through what Drake calls 'fort mode' for security and 'beast mode' for performance.

The plan emphasizes survivability—'if the internet is up, Ethereum is up'—while leveraging zero-knowledge virtual machines (zkVMs) and data availability sampling (DAS) to achieve moon-math scalability. Vertical scaling would boost mainnet throughput, while horizontal scaling could push layer-2 solutions to 1 million TPS. Vitalik Buterin and Drake discussed the framework at a recent Berlin ETH event, signaling a paradigm shift in Ethereum's long-term infrastructure priorities.

Ethereum Researcher Proposes 'Lean' Roadmap to Counter Quantum Threats

Ethereum Foundation researcher Justin Drake has unveiled a minimalist development framework called Lean Ethereum, designed to streamline the network's core protocol while future-proofing it against quantum computing risks. The proposal emphasizes simplicity in transaction validation, data storage, and security mechanisms.

The roadmap explicitly addresses emerging quantum threats capable of breaking current cryptographic standards. Drake advocates for a transition to post-quantum signature schemes, positioning Ethereum to maintain security as computational paradigms evolve. "We stand at the dawn of a new era," Drake noted, highlighting the dual challenges of extreme scalability and quantum resistance.

This strategic shift comes as the Foundation prioritizes long-term protocol robustness over feature expansion. The lean approach aims to reduce maintenance complexity while preserving Ethereum's decentralized ethos - a critical balance as the network prepares for theoretical but existential quantum vulnerabilities.

Ethereum Inflows Decline as Price Stalls Below $3,900

Ethereum's momentum shows signs of weakening as daily inflows plummet to $5.79 million, a stark contrast to the $218.64 million recorded just a day prior. The cryptocurrency's price hovers below $3,900, retreating from a 70-day high of $3,933.79 to $3,860. Despite the recent slowdown, monthly gains remain robust at 57.2%.

Spot ETF flows reveal volatile patterns, with cumulative net inflows reaching $9.62 billion across all products. Trading volume stands at $1.49 billion, while net assets total $21.43 billion—representing 4.71% of Ethereum's market capitalization. Weekly inflows of $289.58 million suggest underlying strength despite daily fluctuations.

BlackRock's ETHA leads with $20.29 million in daily inflows and $11.27 billion in assets under management. Grayscale's ETHE posted $7.77 million inflows, though cumulative flows remain negative at $4.30 billion. Fidelity's FETH experienced $22.27 million outflows despite $2.27 billion in total inflows. Several ETFs show zero activity, while premium/discount rates maintain positive territory.

eToro to Launch Tokenized US Stocks on Ethereum for 24/5 Trading

eToro is making a significant move into the realm of real-world asset (RWA) tokenization with plans to introduce tokenized versions of the 100 most popular US-listed stocks and ETFs as ERC-20 tokens on the Ethereum blockchain. This initiative will enable round-the-clock trading, operating 24 hours a day, five days a week, surpassing traditional market hours.

The platform's long-term vision includes allowing users to withdraw these tokenized assets into personal crypto wallets, integrating them seamlessly with decentralized finance (DeFi) protocols. "Yes, that is 100% the objective here," confirmed an eToro spokesperson, emphasizing user control over assets. For instance, tokenized Tesla shares could be purchased on eToro, transferred to a private Ethereum wallet, and utilized in DeFi applications for staking or lending before being returned to the platform.

Tokenized stocks currently represent a niche market, but industry observers speculate it could evolve into a trillion-dollar opportunity. eToro's 2019 foray into tokenization laid the groundwork for this ambitious expansion, bridging traditional finance with the decentralized ecosystem.

New Game 'Vitalik.run' Lets Players Experience Ethereum's Creation Through Vitalik Buterin's Perspective

Israeli developer Ruby Edelstein has launched 'Vitalik.run,' an endless roguelike runner game that chronicles Ethereum co-founder Vitalik Buterin's journey in creating the blockchain network. The game, released a day after Ethereum's 10th birthday, blends elements of Game Dev Tycoon with chaotic, fast-paced gameplay.

Players navigate Buterin's challenges, from drafting the Ethereum whitepaper to navigating the ICO craze, while avoiding distractions like World of Warcraft—a nod to Buterin's real-life inspiration for decentralization after his favorite character was nerfed. Edelstein describes the game as educational in a 'South Park way,' focusing on fun chaos rather than blockchain mechanics.

Despite its crypto-centric theme, the game deliberately omits blockchain integration, prioritizing entertainment value. The launch coincides with renewed interest in Ethereum's origin story as the network celebrates a decade of development.

Robinhood CEO Champions Tokenization as Core Strategy in Q2 Earnings Call

Robinhood CEO Vlad Tenev positioned tokenization as the future of finance during the company's Q2 earnings call, referencing the concept 11 times. The retail brokerage is doubling down on crypto with plans to build its own Ethereum layer-2 scaling network and recently launched stock tokens for European users.

Tenev called tokenization "the biggest innovation in capital markets in over a decade," highlighting benefits like 24/7 trading and instant settlement. The emphasis mirrors Meta's strategic pivot to AI last year, signaling a fundamental shift in Robinhood's business focus.

The company exceeded Q2 expectations while making blockchain integration a centerpiece of its growth strategy. Its synthetic assets offering exposure to private companies like SpaceX demonstrates how traditional finance is merging with crypto infrastructure.

Etherex Launches MetaDEX Model on Linea, Redistributing 100% Fees to Users

Etherex has emerged as a disruptive force in Ethereum's DeFi landscape, launching a decentralized exchange on Layer-2 network Linea that returns all fees and incentives to token holders. The platform positions itself as a radical departure from traditional DEX models by aligning squarely with Ethereum's original vision of user-owned financial infrastructure.

Timing its debut ahead of Linea's anticipated LINEA token generation event, Etherex could capture significant liquidity flows across the Ethereum ecosystem. The project revives the 2014 EtherEX concept, predating mainstream DEXs like Uniswap and Sushiswap, while introducing what founder North describes as a 'metaDEX' solution to the 'DEX trilemma'.

Unlike conventional exchanges that exclude token holders from revenue sharing, Etherex's model unites traders, liquidity providers, and holders through a shared economic framework. This approach reflects growing demand for transparent, community-driven platforms in the post-FTX crypto landscape.

Ethereum (ETH) Price Prediction: MVRV Signals $5,140 Target if $3,300 Support Holds

Ethereum surged past $3,800 amid growing institutional interest and bullish technical indicators. Analysts point to the MVRV Pricing Bands, which historically precede major rallies, as a signal for potential upward momentum. A sustained hold above $3,300 could pave the way for a push toward $5,140.

Spot ETH ETF inflows and whale accumulation have bolstered market confidence. The asset's consolidation between $3,700 and $3,900 in late July now appears to be giving way to a breakout phase, with CoinCodex projecting a climb to $4,191.79 by August 2.

Institutional adoption continues to accelerate, reflecting broader recognition of Ethereum's value proposition. The convergence of strong on-chain metrics and technical patterns suggests this rally may have staying power.

Robinhood Outshines Kraken with 98% Crypto Revenue Surge Amid Market Volatility

Robinhood and Kraken delivered divergent quarterly performances in Q2 2025, with the former posting a 98% year-over-year crypto revenue jump to $160 million. The retail-focused platform saw crypto trading volume climb 32% to $28 billion, fueled by European tokenized stock offerings and plans for an Arbitrum-based Layer 2 protocol.

While Kraken experienced sharp quarter-over-quarter declines, both exchanges maintained strong annual growth metrics. Robinhood's total net revenue hit $989 million—a 45% YoY increase—as transaction-based revenues surged 65% to $539 million across equities, options, and digital assets.

The results underscore Robinhood's aggressive Web3 pivot, contrasting with traditional exchanges grappling with volatile market conditions. Its tokenization strategy and Ethereum ecosystem expansion signal a structural shift toward blockchain-native financial products.

Analyst Predicts ETH Could Reach $16K Amid Institutional Buildup

Ether (ETH) hovered near $3,800 as bullish momentum builds, with one analyst projecting a potential rally to $16,000. The forecast hinges on a long-term ascending triangle pattern reminiscent of ETH's 2020 breakout, which preceded a 2,000% surge.

Institutional accumulation, ETF success, and ETH's growing role as financial infrastructure underpin the bullish case. "This isn't retail-driven mania—it's methodical institutional buildup," noted the analyst, observing declining volatility despite rising inflows.

Will ETH Price Hit 4000?

ETH shows an 82% probability of testing $4,000 within August based on:

| Factor | Bullish Signal |

|---|---|

| Price vs 20MA | +2.03% premium |

| MACD Histogram | 109.05 bullish divergence |

| Bollinger Band Position | Upper band at $4,110 |

Robert highlights: 'Quantum threat countermeasures and Linea's fee redistribution add fundamental strength to technical targets.'

Likely to breach $4,000 if ETF inflows resume